how much is renters credit on taxes

LIHTC participants have a unit assigned to them by a. For assistance calculating the alternate credit refer to worksheet 4 Alternate Property Tax Credit for Renters Age 65 and Older in the MI-1040 Individual Income Tax.

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able to Claim a Renters Tax Credit If You Live in These States Claiming a renters credit on your taxes can help put money back in your pocket Eligibility.

. The renters property tax refund program sometimes called the renters credit is a state-paid refund that provides tax relief to renters whose rent and implicit property taxes are high. Furthermore any origination fees credit card interest and refinancing your rental property are just some of the. 275 amount of tax credit The 275 difference is the amount the renter would receive as a tax credit.

The Low-Income Housing Tax Credit LIHTC subsidy program allows low and moderate-income renters to pay rent at an affordable rate. 43533 or less if your filing status is single or marriedregistered. The amount of the renters tax credit will vary according to the.

This deduction is limited to 50 of the rent paid and cannot exceed a total deduction of 3000. Renters earning less than 43533 a year are eligible for a 60 tax credit and renters earning less than 87066 a year who are married and file taxes jointly are eligible for. The marginal tax bracket you are in of which there are 7 between 10 and 37 depends on your filing status and the amount of taxable income you report for the year.

Mail the completed form to. Renters insurance deductibles commonly range from 250 to 2000. You or a member of your household paid rent for your residence.

Thats because your insurance company will. Based on rent paid in 2016 and 2016 incomes 324840 renters received refunds. In California renters who make less than a certain amount currently 41641.

Then multiply this figure by 12 and this is the amount you can deduct. Vermont Department of Taxes. For questions about filing a renter credit claim contact us at.

Where there is an. The higher your deductible the less youll pay in premiums. If you qualify for the OEPTC benefit it will be added to the payment for the Ontario sales tax credit andor the NOEC and youll receive one combined Ontario Trillium Benefit.

That being said each state has its own unique set of rules and we get into these specifics below. The 500 per year relief has been. A big tax credit was introduced for renters in Budget 2023 which will allow tenants squeezed by the housing crisis to claim as much as 1000.

The average monthly rent you and other members of your household paid was 450 or less not. Threshold claimed that the Governments 500 annual tax credit for renters is only enough to cover seven days worth of rent in the average Dublin rental. The average refund was 653 and the total dollar amount of refunds paid statewide was.

You paid rent in California for at least 12 the year The property was not tax exempt Your California income was. Rent paid by third party on taxpayers behalf If rent is paid by a third party.

Top Rental Income Tax Deductions Rentals Resource Center

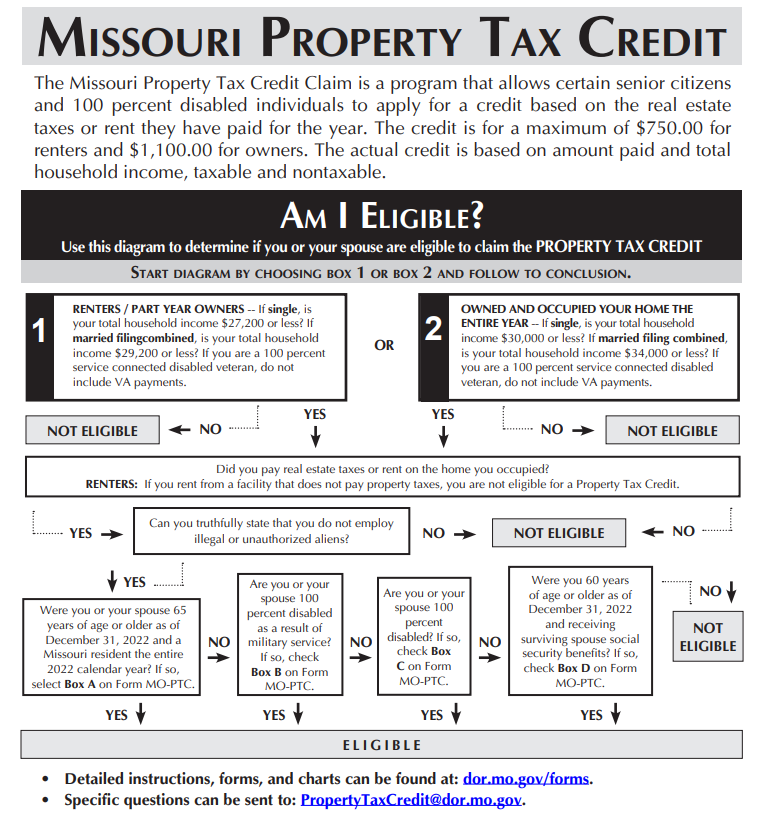

Property Tax Claim Eligibility

How To Take Advantage Of Education Tax Credits Forbes Advisor

New Property Tax Relief Program Would Assist 1 8m Nj Homeowners Renters Njbiz

Could You Get Home Energy And Ev Incentives Under The Canary Media

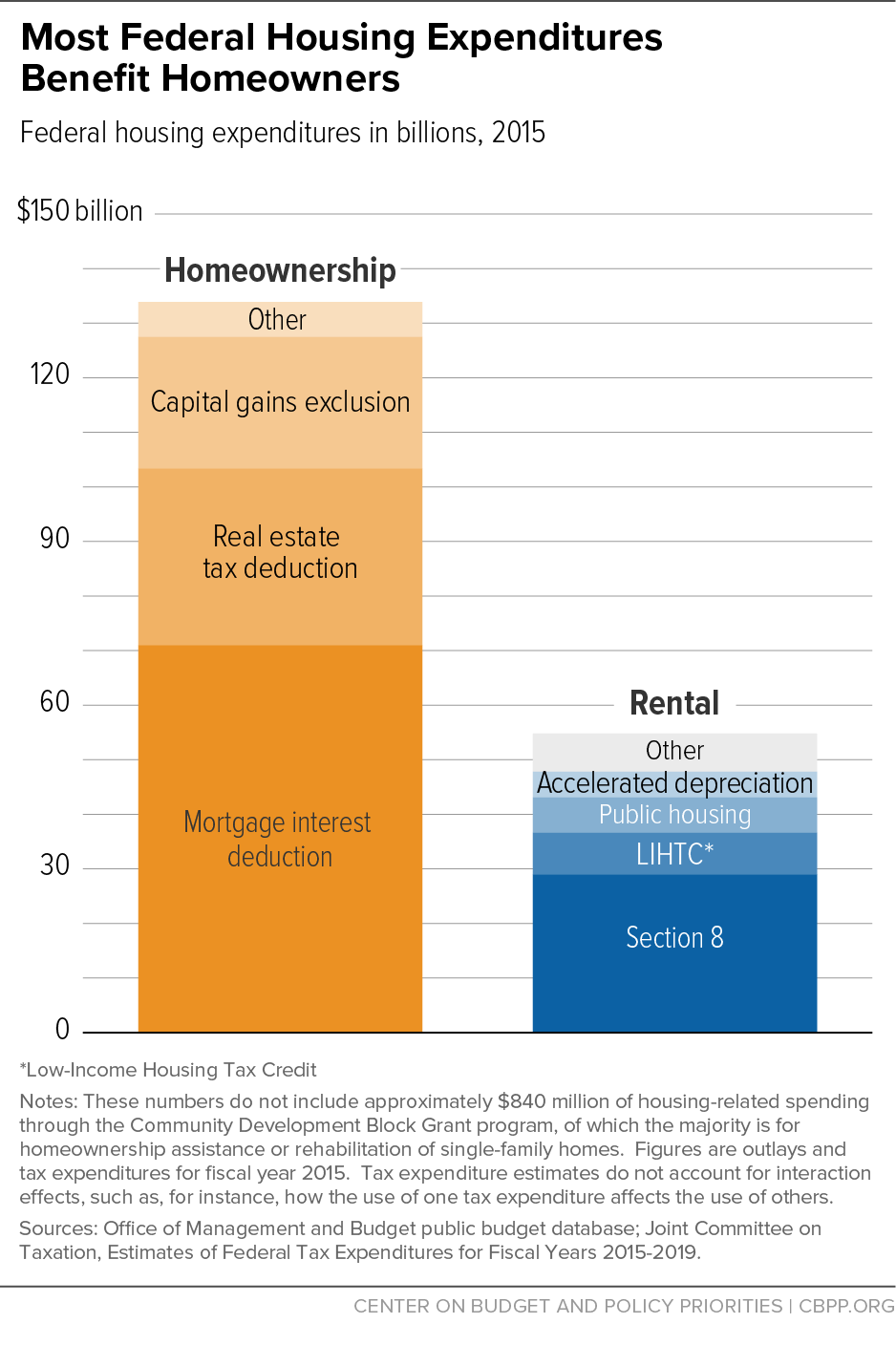

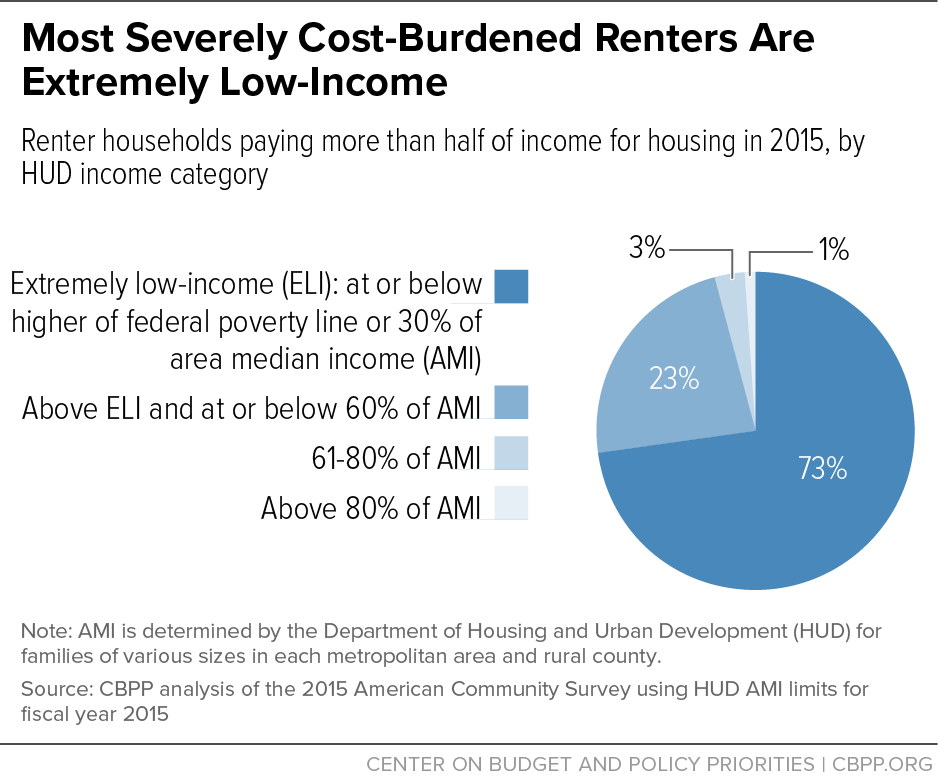

Renters Tax Credit Would Reduce Housing Cost Burdens Center On Budget And Policy Priorities

Property Tax Credits Are You Eligible City Of Takoma Park

Tax Refund Advice For Nyc Homeowners Renters Streeteasy

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

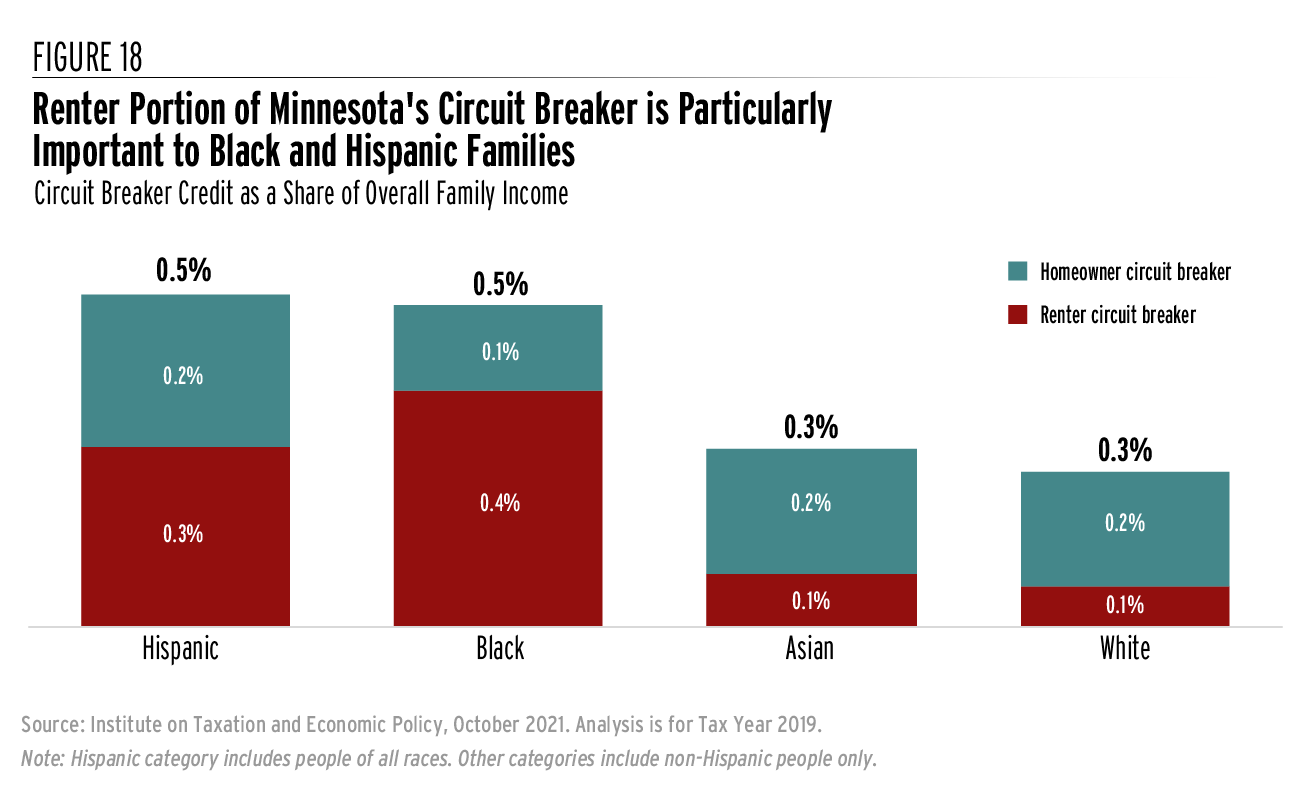

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Rental Real Estate And Taxes Turbotax Tax Tips Videos

Rental Property Tax Deductions A Comprehensive Guide Credible

Can A Renter Claim Property Tax Credits Or Deductions In California

10 Rental Property Tax Deductions For Landlords 2022 Bungalow

Renters Credit Would Help Low Wage Workers Seniors And People With Disabilities Afford Housing Center On Budget And Policy Priorities

Tax Preparation Program Wayne Metro Community Action Agency

/cdn.vox-cdn.com/uploads/chorus_image/image/64083117/GettyImages_1056893408__1_.0.jpg)

The Renters Tax Credit A Staple Of Democratic Housing Plans Explained Curbed

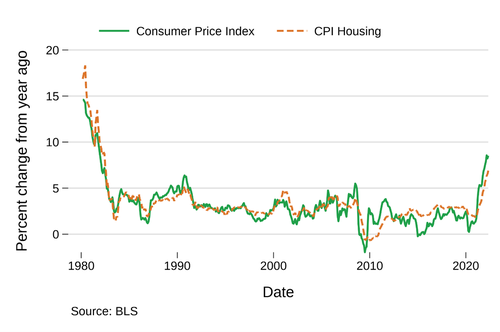

Office Of Research Blog Housing Inflation Is Hitting Low Income Renters Consumer Financial Protection Bureau

Do I Have To Claim Income From Renting A Room In My Primary Residence If I M Not Making Any Money Comparative To Costs